eNaira: Fostering Women Financial Independence and Promoting Inclusion

By Deborah Enyone Oni

Introduction

The world is heading towards a cashless society of which Nigeria has taken proactive steps as it has introduced a lot of cashless policies of which eNaira is a part of. This has helped in fostering women financial independence and promoting inclusion.

In an era where digital transformation is reshaping economies worldwide, Nigeria has taken a significant and laudable step towards financial innovation with the introduction of the eNaira, the country’s digital currency. With potential to revolutionize the way we transact and manage money, eNaira presents unique opportunities for women to enhance their financial independence and participate actively in the digital economy.

In a recent publication by the International Monetary Fund, 2023, It states that the level of global interest in Central Bank Digital Currencies (CBDCs) is unprecedented. Over 100 countries are exploring retail CBDC issuance. Several central banks have already launched pilots or even issued a CBDC.

The IMF’s Digital Money Strategy, endorsed by its Executive Board in July 2021, gives the institution a mandate to help ensure that digital money fosters domestic and international economic and financial stability. CBDC, in particular, will likely have important implications for monetary policy, financial stability, and the international monetary system (IMS).

In this article, we will shed light on what the eNaira is with the aim of helping us to understanding the eNaira and how it is fosters women financial independence and promote inclusion. It will also highlighting its benefits so as to steer the minds of women and all to be proactive and leverage the potentials of the eNaira. Finally, it will share insights into the legal and regulatory framework and explain how to get started with the eNaira platform for a seamless onboarding, and user experience.

Understanding the eNaira

eNaira is Nigeria’s Central Bank Digital Currency(CBDC). The Central Bank of Nigeria directly backs eNaira, which was launched by former President Muhammadu Buhari on October 25, 2021.

This digital currency is designed for digital transactions and exists solely in digital form. It is a legal tender and will form part of the currency in circulation.

As a digital currency, eNaira operates on a blockchain-based platform, ensuring transparency and security in transactions. Its blockchain feature differentiates it from the traditional money. The eNaira serves as a complement to the existing physical currency. Hence its motto, eNaira: same Naira, more possibilities.

The introduction of the eNaira is a part of Nigeria’s effort in embracing digital innovation, driving financial inclusion, economic development, paving way for a more digital future and a response to the global demands towards digitisation.

The Central Bank of Nigeria was the first to introduce eNaira in Africa and the second in the world.

eNaira ranks first on PricewaterhouseCoopers (PWC) Global Index of top retail Central Bank Digital Currencies (CBDCs).

It is important to note that there is a financial shift globally, and there is a need to educate yourself about it and align in order to harness the potentials in it.

eNaira has the potential of revolutionizing the way Nigerians transact and engage in financial activities and presents an incredible opportunity to bridge the gender gap and improve financial inclusion of women.

It is important to educate women on the available opportunities they can leverage to boost their financial empowerment.

In understanding the Opportunities/how eNaira is fostering women financial independence and inclusion, Let’s look into the benefits and opportunities of eNaira:

Benefits of eNaira

eNaira provides a unique form of money denominated in Naira. eNaira serves as both a medium of exchange and a store of value, offering better payment prospects in retail transactions when compared to cash payments. Below are some of the benefits of eNaira:

- Financial inclusion: eNaira holds the potential to bridge the gender gap in financial inclusion. With traditional banking often inaccessible to women in rural areas, eNaira provides a digital platform that allows women to participate in the formal economy, access financial services, and take control of their finances.

- Reduced Transaction Costs: eNaira can help to reduce transaction costs associated with traditional banking systems. Digital transactions often have lower fees compared to physical transactions or traditional banking services, enabling users to save money on transaction fees and potentially increase their disposable income.

- It offers financial freedom for women: eNaira enables women to overcome financial limitations and achieve greater financial freedom .

- It fosters women inclusivity: eNaira plays a crucial role in fostering women’s inclusivity and breaking barriers that have hindered their participation in the finance sector.

- It offers fast transaction time: Process eNaira transactions electronically, eliminating the need for manual handling or paperwork. The digital process streamlines the transaction flow, reducing processing times and enabling faster completion of financial transactions. Users can send and receive payments with greater speed and efficiency compared to traditional banking methods.

- It offers cross-border payment option: eNaira allows users to make cross-border transactions without the need for physical currency or traditional banking intermediaries.

How does eNaira help in fostering women financial independence and inclusion?

- Financial independence: According to recent studies, women in Nigeria face barriers to financial independence. Only a fraction having access to formal financial services . However, with the introduction of eNaira, the landscape is rapidly changing. More women using eNaira for financial transactions has led to fostering women financial independence.

- Entrepreneurial growth: eNaira is unlocking a world of possibilities for women entrepreneurs. By embracing this digital currency, women-owned businesses can enjoy a convenient, secure, and cost effective method for receiving payments, managing cash flow, and expanding their ventures online. eNaira provides the tools for women entrepreneurs to thrive, access funding, and reach new customers, thereby fostering their growth and success.

- Accessible financial education: financial literacy is the key to unlocking the full potential of eNaira. by investing in education and training , women can gain the necessary skills to navigate the digital currency landscape effectively. Workshops, online resources, and mentorship programs can empower women with knowledge, enabling them to make informed financial decisions and maximise the benefits of eNaira.

- Secure and transparent transactions: eNaira prioritizes security and transparency in financial transactions. Advanced encryption and a secure digital ecosystem enable women to confidently engage in online payments, e-commerce, and other financial activities. The trust and security provided by eNaira allows women to transact with peace of mind, knowing their financial data is protected.

- Collaboration and Networking: To fully realise the potential of eNaira, Collaboration and Networking are essential. Let’s come together to build a supportive ecosystem that encourages women’s involvement in the digital currency revolution. Collaborate through partnerships, networks, and initiatives to promote women’s financial inclusion, share insights, and create growth opportunities.

Legal and Regulatory Framework

- The Central Bank of Nigeria, under the Central Bank of Nigeria (CBN) Act 2007 and the Banks and Other Financial Institutions Act (BOFIA) 2020, is empowered to issue legal tender currency, ensure financial system stability and promote the development of electronic payments system.

- The Central Bank of Nigeria in furtherance to its mandate issued the Guidelines for the operation of the eNaira, to encourage general acceptability and use, promote low cost of transactions, drive financial inclusion while minimizing inherent risks of disintermediation or any negative impact on the financial system.

- The CBN issues eNaira in line with section 19 of the CBN Act.

- AML/CFT Compliance on eNaira

- AML/CFT checks for fraud prevention and detection shall apply to the eNaira platform.

- Financial institutions are required to comply with the Money Laundering (Prohibition) Act 2011(as amended),

- The Terrorism (Prevention) Act 2011 (as amended) and

- All subsisting Anti-Money Laundering Laws and regulations as may be issued by the CBN from time to time.

- eNaira users will follow a tiered structure with transaction and balance limits.

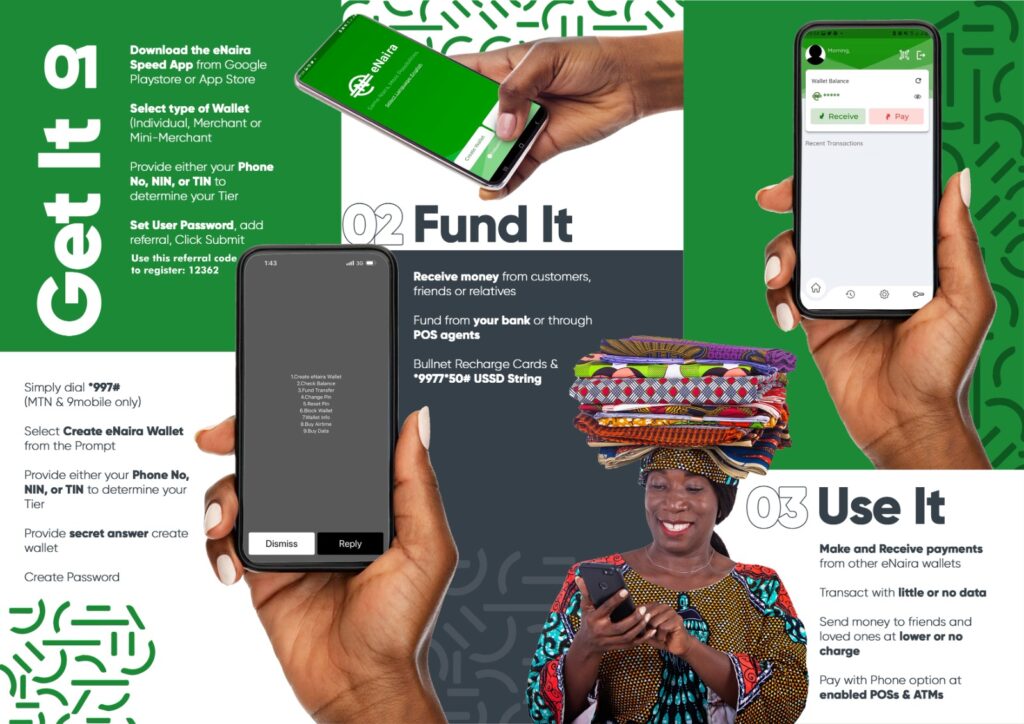

Getting started with eNaira

- Creating an eNaira wallet: If you are interested, embrace eNaira by creating a digital wallet. Follow the registration process diligently and safeguard your login details for a seamless and secure experience.

- Understanding transactions: It is crucial to understand and familiarize oneself with eNaira transaction methods. These methods includes sending and receiving payments, making online purchases, and exploring networks of businesses accepting eNaira. By understanding these processes, women can utilize eNaira to its full potential and enjoy the benefits it offers.

- Promoting financial literacy: as eNaira gains momentum, investing time in understanding the dynamics of digital currency becomes crucial. Engage in financial literacy programs , attend workshops, or seek guidance from experts to enhance knowledge about managing eNaira effectively.

- Embracing opportunities: eNaira opens doors to new opportunities, and women should actively seek them. Explore partnerships, collaboration, and initiatives specifically designed to support women in the digital economy.

Please note that eNaira has its benefits as well as its challenges as is the case with any nascent technology. However, from its implementation and experiencing real world usage, it is evolving. It is pertinent to explore the potential benefits and leverage same as an innovation around the blockchain technology.

If you are passionate about empowering women, I invite you to join the conversation. Lets connect, share insights, and collaborate to drive women’s financial independence and inclusion with eNaira.

To register on the eNaira platform to create your wallet and begin to transact, use the link below:

https://mywallet.enaira.gov.ng/registration/12362

Further insight on leveraging the eNaira, kindly register with the link above for the forthcoming webinar on:

eNaira: Fostering Financial Inclusion for women

https://forms.gle/vc2aMqRHJ6M5jx18A

#eNaira#digitaleconomy #financialindependence

#womenempowerment #financialinclusion#entrepreneurship #financialeducation#collaboration #networking #cbn

#deborahenyoneoni

#hiltontopsolicitors

#emergingtech

#digitalfinance

#futureofmoney